In the realm of retirement planning, Self-Directed Individual Retirement Accounts (SDIRAs) have gained significant traction, particularly in the context of investing in alternative assets such as gold and silver. This report delves into the intricacies of self-directed IRAs, focusing on the benefits, regulations, and strategies associated with investing in precious metals like gold and silver.

What is a Self-Directed IRA?

A Self-Directed IRA is a type of individual retirement account that allows investors to have greater control over their investment choices. Unlike traditional IRAs, which typically limit investments to stocks, bonds, and mutual funds, a self-directed IRA opens the door to a wide array of investment options, including real estate, private equity, and precious metals. This flexibility allows investors to diversify their portfolios and potentially achieve higher returns.

The Appeal of Gold and Silver Investments

Gold and silver have long been regarded as safe-haven assets, particularly during times of economic uncertainty. Their intrinsic value, coupled with a limited supply, makes them attractive to investors seeking to hedge against inflation and currency devaluation. Moreover, precious metals often exhibit a negative correlation with traditional financial markets, providing a buffer during market downturns.

Investing in gold and silver through a self-directed IRA offers several benefits:

- Tax Advantages: Like traditional IRAs, self-directed IRAs provide tax-deferred growth. This means that investors do not pay taxes on gains until they withdraw funds during retirement, allowing for potentially greater accumulation of wealth.

- Diversification: Including gold and silver in an investment portfolio can enhance diversification. Precious metals can act as a counterbalance to stocks and bonds, reducing overall portfolio volatility.

- Control: Investors have the autonomy to choose their investments, enabling them to tailor their portfolios according to their risk tolerance and financial goals.

Regulations Governing Precious Metals in SDIRAs

While self-directed IRAs offer flexibility, they are also subject to specific regulations that investors must adhere to. The Internal Revenue Service (IRS) has established guidelines regarding the types of precious metals that can be held in an IRA. To qualify, gold and silver must meet certain purity standards:

- Gold: Must be 99.5% pure (24 karats).

- Silver: Must be 99.9% pure.

It is crucial for investors to work with a custodian or trustee who specializes in self-directed IRAs and gold ira investments for retirement has experience in handling precious metal investments. If you loved this short article along with you would want to be given more details relating to gold ira investments for retirement i implore you to stop by our own page. Custodians are responsible for ensuring compliance with IRS regulations and managing the administrative aspects of the account.

Setting Up a Self-Directed IRA for Precious Metals

The process of setting up a self-directed IRA for gold and silver investments involves several steps:

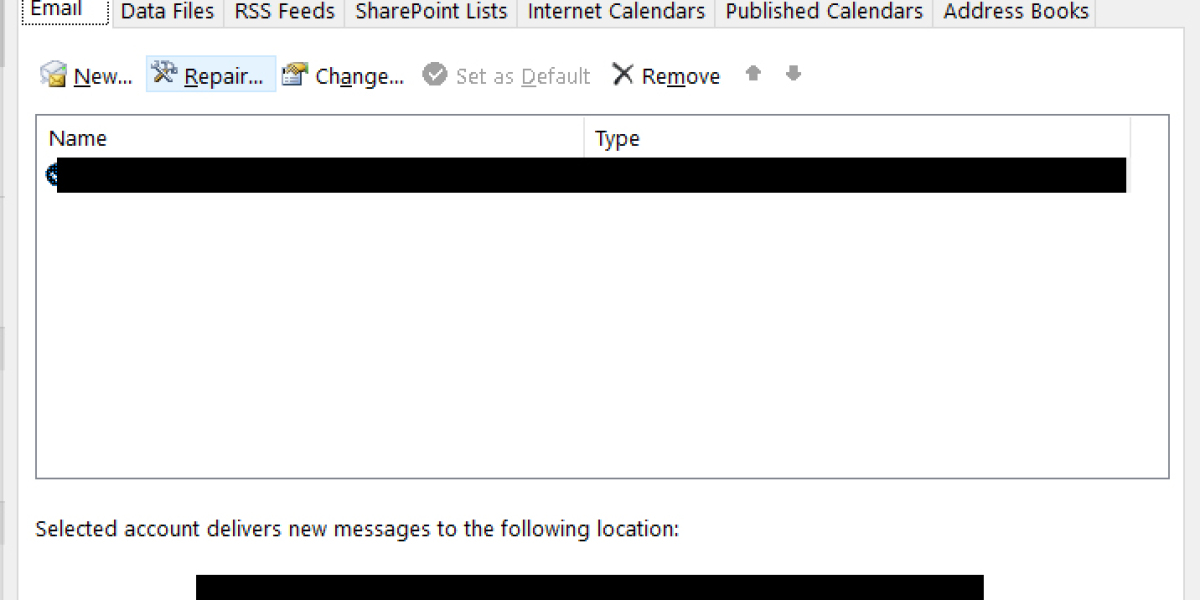

- Choose a Custodian: gold ira investments for retirement Research and select a reputable custodian that specializes in self-directed IRAs and precious metals. Ensure they are IRS-approved and have a solid track record.

- Open an Account: Complete the necessary paperwork to establish your self-directed IRA account. This typically includes providing personal information and selecting the type of account (traditional or Roth).

- Fund Your Account: You can fund your self-directed IRA through various means, including rolling over funds from an existing retirement account, making contributions, or transferring assets.

- Select Your Investments: Once your account is funded, you can direct your custodian to purchase gold and silver on your behalf. Ensure that the chosen investments comply with IRS guidelines.

- Storage: Precious metals held in a self-directed IRA must be stored in an approved depository. Investors cannot personally hold the metals; they must be stored in a secure location that meets IRS regulations.

Risks and Considerations

While investing in gold and silver through a self-directed IRA can offer numerous advantages, it also carries certain risks and considerations:

- Market Volatility: Precious metals can experience significant price fluctuations. Investors should be prepared for the potential of market volatility and understand that prices can be influenced by various factors, including geopolitical events and economic conditions.

- Liquidity: Unlike stocks and bonds, selling physical gold and silver can be less liquid. Investors may face challenges in quickly converting their investments into cash, especially during times of high demand.

- Fees: Self-directed IRAs often come with higher fees compared to traditional IRAs. Custodial fees, storage fees, and transaction fees can add up, impacting overall returns.

- Regulatory Compliance: Investors must remain vigilant about IRS regulations to avoid penalties. Failure to comply with rules regarding prohibited transactions or storage can result in disqualification of the IRA and tax liabilities.

Conclusion

Investing in gold and silver through a self-directed IRA can be a powerful strategy for retirement planning, offering diversification, tax advantages, and a hedge against economic uncertainty. However, it is essential for investors to conduct thorough research, understand the regulatory landscape, gold ira investments for Retirement and work with experienced custodians to navigate the complexities of self-directed IRAs.

As the financial landscape continues to evolve, incorporating precious metals into a retirement strategy can provide a sense of security and stability. By leveraging the unique benefits of self-directed IRAs, investors can take control of their retirement futures and make informed decisions that align with their long-term goals.