In an age where economic uncertainty looms and inflation rates fluctuate, investors are increasingly seeking refuge in tangible assets. Among these, gold has long been a symbol of stability and security. Recognizing this trend, Fidelity Investments has introduced a Gold-Backed Individual Retirement Account (IRA), offering investors a unique opportunity to diversify their retirement portfolios with precious metals. This move not only reflects the growing demand for gold as an investment vehicle but also highlights the advantages of incorporating such assets into retirement planning.

Understanding Gold-Backed IRAs

A Gold-Backed IRA is a self-directed retirement account that allows investors to hold physical gold and other precious metals as part of their retirement savings. Unlike traditional IRAs, which typically consist of stocks, bonds, and mutual funds, a Gold-Backed IRA provides a hedge against market volatility by including assets that have historically retained value over time. Fidelity’s introduction of this product aims to cater to investors looking for a stable investment in a turbulent economic climate.

The Benefits of Gold as an Investment

Gold has been revered for centuries as a safe haven asset, particularly during times of economic distress. Its intrinsic value tends to rise when other asset classes, such as stocks and bonds, ira investing best gold ira companies experience downturns. This inverse relationship makes gold an attractive option for investors seeking to mitigate risk. Additionally, gold is a finite resource, which means its value is less likely to be affected by inflation or currency fluctuations, making it a reliable store of wealth.

Investing in a Gold-Backed IRA allows individuals to leverage these benefits while also enjoying the tax advantages associated with retirement accounts. Contributions to a Gold-Backed IRA can be made on a pre-tax basis, reducing taxable income in the year of contribution. Furthermore, any gains realized within the account are tax-deferred until withdrawal, providing a strategic advantage for long-term investors.

Fidelity’s Gold-Backed IRA: Features and Offerings

Fidelity’s Gold-Backed IRA stands out due to its comprehensive approach to investment management. The firm offers a range of gold products, including bullion coins and bars, sourced from reputable mints and refiners. Investors can choose from various forms of gold, ira investing best gold ira companies including American Gold Eagles, Canadian Gold Maple Leafs, and gold bars of varying weights.

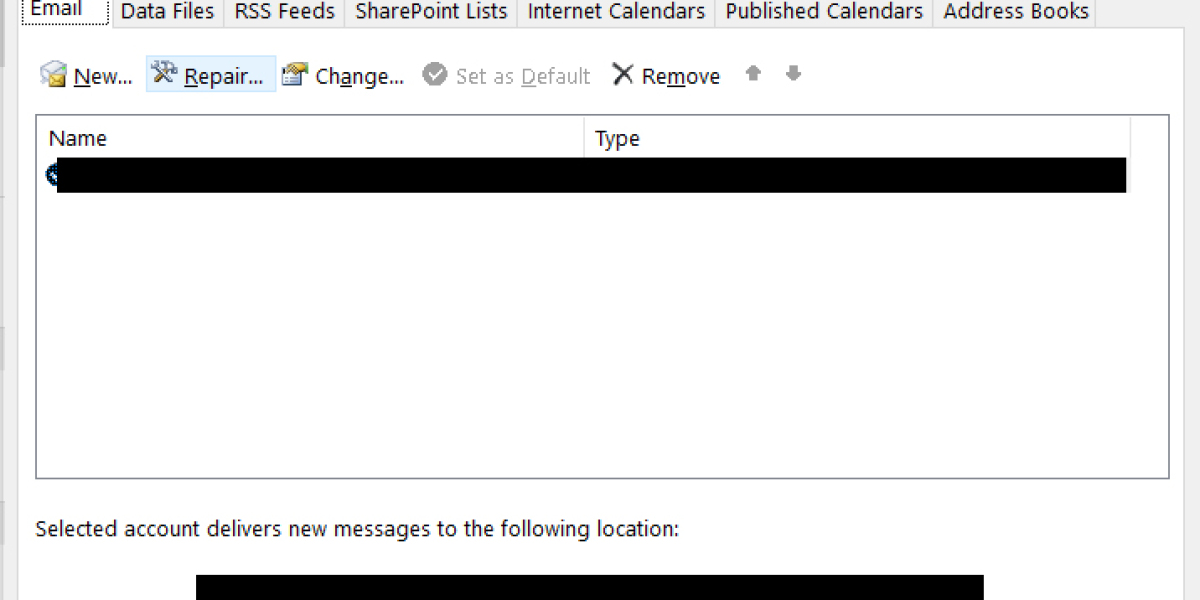

One of the key features of Fidelity’s Gold-Backed IRA is its user-friendly online platform, which allows investors to easily manage their accounts, track performance, and execute transactions. Fidelity also provides educational resources and tools to help investors make informed decisions about their gold investments. This commitment to transparency and education is particularly valuable for individuals who may be new to investing in precious metals.

Security and Storage Solutions

A significant concern for investors in physical gold is security. Fidelity addresses this issue by partnering with established custodians that specialize in the secure storage of precious metals. The gold held within a Fidelity Gold-Backed IRA is stored in highly secure, insured facilities, ensuring that investors’ assets are protected against theft or loss. This level of security is crucial for building trust among investors, particularly those who may be hesitant about investing in physical commodities.

The Role of Gold in Diversification

Diversification is a fundamental principle of sound investing, and incorporating gold into a retirement portfolio can enhance overall risk management. By allocating a portion of retirement savings to gold, investors can reduce their exposure to market volatility and ira Investing best gold ira Companies enhance the stability of their portfolios. Fidelity’s Gold-Backed IRA allows individuals to create a balanced investment strategy that includes both traditional assets and precious metals.

Financial advisors often recommend that investors maintain a diversified portfolio to weather economic fluctuations. Should you have any kind of inquiries with regards to where as well as tips on how to work with ira investing best gold ira companies, it is possible to e mail us in our own web-site. Gold’s unique characteristics make it a valuable addition to any investment strategy, particularly during periods of economic uncertainty. As such, Fidelity’s Gold-Backed IRA can serve as a cornerstone for individuals looking to build a robust retirement plan.

The Growing Popularity of Precious Metals

The demand for gold and other precious metals has surged in recent years, driven by geopolitical tensions, economic instability, and a growing awareness of the benefits of alternative investments. As central banks around the world continue to increase their gold reserves, retail investors are also recognizing the importance of including precious metals in their portfolios.

Fidelity’s entry into the Gold-Backed IRA market reflects this growing trend and positions the firm as a leader in the investment space. By offering a dedicated platform for gold investments, Fidelity is catering to a demographic that values both security and diversification in their retirement planning.

Considerations for Investors

While the benefits of a Gold-Backed IRA are compelling, potential investors should also be aware of certain considerations. First, it’s essential to understand the fees associated with setting up and maintaining a Gold-Backed IRA. These may include storage fees, transaction fees, and management fees, which can vary by provider. Investors should conduct thorough research to understand the total cost of ownership before committing to this investment vehicle.

Additionally, individuals should consider their overall investment goals and risk tolerance when deciding how much to allocate to gold within their retirement portfolios. While gold can provide stability, it is essential to maintain a diversified approach that includes a mix of asset classes.

Conclusion

Fidelity’s Gold-Backed IRA offers a compelling solution for investors seeking to incorporate physical gold into their retirement savings. With its robust features, secure storage options, and commitment to investor education, Fidelity is well-positioned to meet the needs of a growing market. As economic uncertainties continue to challenge traditional investment strategies, gold remains a reliable asset that can enhance portfolio stability and provide peace of mind for investors planning for their financial futures. As more individuals recognize the value of diversifying their retirement savings with precious metals, Fidelity’s Gold-Backed IRA may become an increasingly attractive option in the years to come.