In today's financial landscape, many individuals find themselves grappling with the challenges of bad credit. Whether it's due to unforeseen medical expenses, job loss, or other financial hardships, a low credit score can significantly limit one's borrowing options. If you liked this article and you would like to collect more info regarding personal loans online approval bad credit please visit our own web-site. However, the emergence of bad credit personal loans with guaranteed approval has provided a lifeline for those in need of immediate financial assistance. This article explores the intricacies of these loans, their implications, and how they can serve as a viable solution for individuals seeking to secure $5,000 despite their credit history.

The Concept of Bad Credit Personal Loans

Bad credit personal loans for bad credit greenville nc loans are specifically designed for borrowers with poor credit scores, typically defined as a score below 580. These loans offer a chance for individuals to access funds for various purposes, such as consolidating debt, covering emergency expenses, or financing a significant purchase. The appeal of guaranteed approval loans lies in their accessibility; lenders often prioritize the borrower's ability to repay over their credit history.

The Promise of Guaranteed Approval

The term "guaranteed approval" can be somewhat misleading. While it implies that all applicants will be approved for a loan, the reality is more nuanced. Lenders may still conduct a basic assessment of an applicant's financial situation, including income verification and employment status. However, these loans are structured to minimize the barriers typically associated with traditional lending processes, making them more accessible for those with bad credit.

Loan Amounts and Terms

For individuals seeking personal loans, the amount of $5,000 is a common target. This sum is often sufficient to address urgent financial needs without overwhelming the borrower. Most lenders offering bad credit personal loans provide flexible repayment terms, ranging from 12 to 60 months. This flexibility allows borrowers to choose a repayment schedule that aligns with their financial capabilities.

Interest Rates and Fees

One of the critical aspects to consider when applying for a bad credit personal loan is the interest rate. Lenders often charge higher rates to mitigate the risk associated with lending to individuals with poor credit histories. Interest rates can vary significantly, typically ranging from 10% to 36% or more, depending on the lender and the borrower's financial profile. Additionally, borrowers should be aware of any associated fees, such as origination fees or prepayment penalties, which can impact the overall cost of the loan.

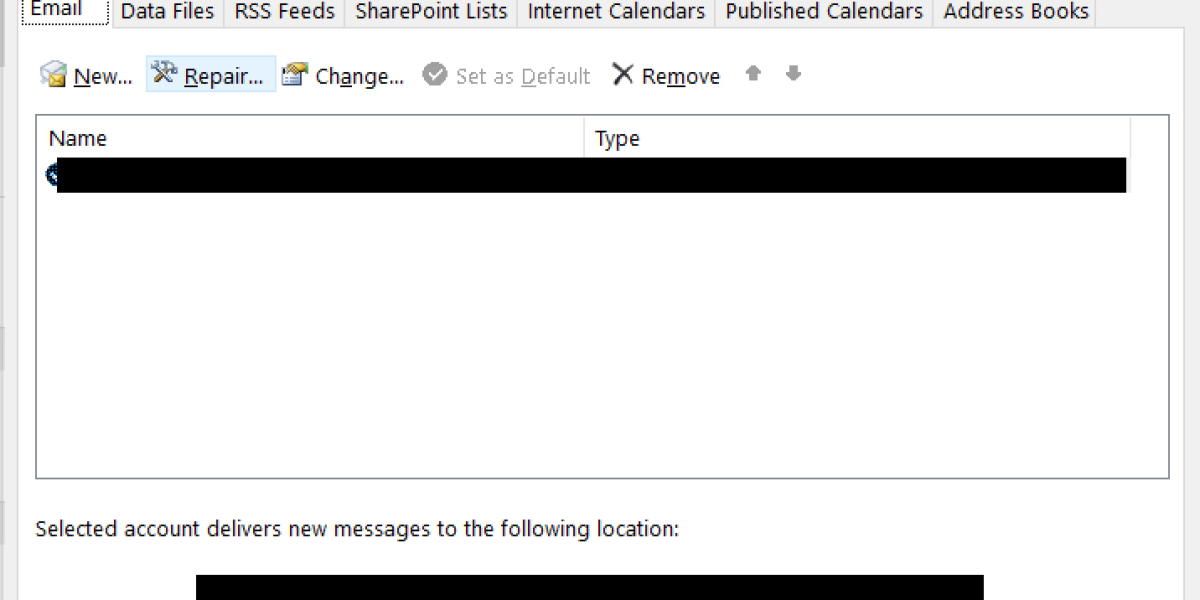

The Application Process

Applying for a bad credit 1000 dollar personal loan bad credit loan is generally straightforward. Most lenders offer online applications, allowing borrowers to complete the process from the comfort of their homes. Applicants typically need to provide personal information, including their Social Security number, employment details, and income information. Some lenders may also require bank statements or other documentation to verify financial stability.

The Role of Lenders

Lenders specializing in bad credit personal loans often operate outside the traditional banking system. They may include online lenders, credit unions, and peer-to-peer lending platforms. These lenders are more likely to consider alternative factors beyond credit scores, such as income stability and repayment history. This approach allows them to extend loans to individuals who may be overlooked by conventional banks.

Risks and Considerations

While bad credit personal loans with guaranteed approval offer a pathway to financial relief, they are not without risks. Borrowers should exercise caution and thoroughly evaluate their financial situation before committing to a loan. High-interest rates can lead to a cycle of debt if borrowers are unable to meet their repayment obligations. Additionally, taking on new debt can impact credit scores further if payments are missed or delayed.

Improving Credit Through Responsible Borrowing

Interestingly, obtaining a bad credit personal loan can also serve as an opportunity for borrowers to improve their credit scores. By making timely payments and managing the loan responsibly, individuals can demonstrate positive financial behavior, which can gradually enhance their credit profiles. This process highlights the importance of viewing loans not only as a means of immediate relief but also as a stepping stone toward long-term financial health.

Alternative Solutions for Bad Credit Borrowers

While bad credit personal loans can be a beneficial option, they are not the only solution available to those with poor credit. Individuals may also explore alternatives such as secured loans, which require collateral, or credit counseling services that can provide guidance on managing debt and improving credit scores. Additionally, some organizations offer financial assistance programs designed to help individuals facing financial hardship.

Conclusion

In conclusion, bad credit personal loans with guaranteed approval for $5,000 present a viable solution for individuals seeking financial assistance despite their credit challenges. While these loans offer accessibility and convenience, borrowers must approach them with caution, considering the associated risks and costs. By understanding the intricacies of these loans and exploring responsible borrowing practices, individuals can navigate their financial challenges and work toward rebuilding their credit profiles. Ultimately, the key to leveraging bad credit hard money personal loans bad credit loans lies in making informed decisions and prioritizing financial responsibility.