In recent years, the landscape of personal loans for bad credit and cosigner finance has evolved significantly, particularly for individuals with bad credit. In Knoxville, Tennessee, the demand for hard money personal loans bad credit loans among those with poor credit histories has surged, prompting a closer examination of the options available, the challenges faced, and the implications for borrowers. This observational research article aims to shed light on the personal loan market for bad credit in Knoxville, exploring the experiences of borrowers, the lending practices of financial institutions, and the broader economic context.

The Landscape of Bad Credit Personal Loans in Knoxville

Knoxville, a vibrant city nestled in the foothills of the Great Smoky Mountains, boasts a diverse economy. However, like many regions, it is not immune to the challenges posed by economic downturns, job losses, and unexpected expenses. Many residents find themselves in situations where they need quick access to cash, yet their credit scores hinder their ability to secure traditional loans from banks and credit unions.

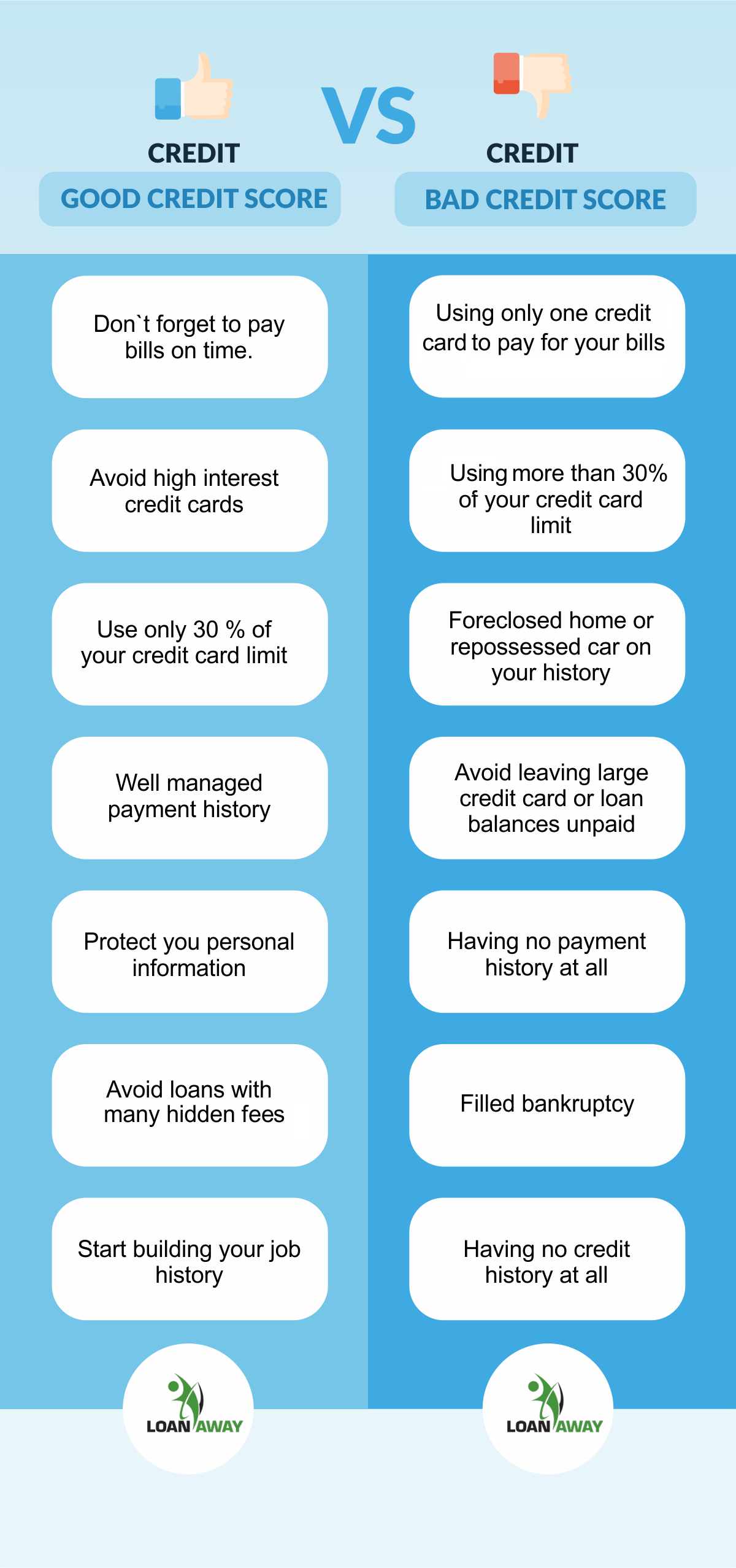

Personal loans for individuals with bad credit typically come from alternative lenders, including online platforms and local finance companies. These lenders often have more lenient criteria for approval, making them an appealing option for borrowers who may have been turned away by traditional banks. However, these loans often come with higher interest rates and fees, reflecting the increased risk that lenders take on when working with borrowers with poor credit histories.

Borrower Experiences: Navigating the Process

To gain insights into the experiences of borrowers in Knoxville, interviews were conducted with a diverse group of individuals who had recently sought personal loans despite having bad credit. Many reported feeling a sense of urgency when applying for loans, driven by immediate financial needs such as medical bills, car repairs, or unexpected job losses. This urgency often led to decisions made in haste, with borrowers sometimes overlooking the fine print associated with loan agreements.

One common theme among interviewees was the feeling of being trapped in a cycle of debt. For example, one borrower, Sarah, a single mother of two, shared her experience of taking out a high-interest personal loan to cover unexpected medical expenses. In the event you loved this information and you would want to receive more information concerning 1000 personal loan bad credit please visit the page. While the loan provided immediate relief, the high monthly payments soon became unmanageable, forcing her to consider additional borrowing to stay afloat. Sarah's story is not unique; many borrowers expressed similar sentiments, highlighting the precarious balance between meeting short-term needs and the long term personal loans for bad credit direct lenders-term consequences of high-interest debt.

The Role of Alternative Lenders

Alternative lenders play a significant role in the personal loan market for bad credit in Knoxville. These lenders often employ different underwriting criteria than traditional banks, allowing them to assess a borrower's creditworthiness based on factors beyond just credit scores. For instance, they may consider income, employment history, and even personal references. This flexibility can be a double-edged sword; while it opens the door for many borrowers, it can also lead to predatory lending practices.

During the observational study, it became clear that some alternative lenders in Knoxville were taking advantage of borrowers' desperation. High-interest rates, hidden fees, and aggressive collection practices were reported by several interviewees. One borrower, John, recounted his experience with a local finance company that charged exorbitant fees for late payments, exacerbating his financial struggles. This raises important questions about consumer protection and the need for regulatory oversight in the personal loan industry, particularly for vulnerable populations.

Financial Education and Resources

In light of the challenges faced by borrowers with bad credit, financial education emerges as a crucial component in improving outcomes. Many interviewees expressed a lack of understanding regarding personal finance, credit scores, and the implications of taking on debt. This knowledge gap can lead to poor financial decisions, perpetuating cycles of debt and financial instability.

Organizations in Knoxville are beginning to address this issue by offering financial literacy programs aimed at educating individuals about credit management, budgeting, and responsible borrowing. These initiatives are essential in empowering borrowers to make informed decisions and avoid predatory lending practices. By equipping individuals with the knowledge and tools necessary to navigate the financial landscape, communities can work towards breaking the cycle of bad credit and fostering economic resilience.

The Economic Context: Challenges and Opportunities

The broader economic context in Knoxville also plays a significant role in shaping the personal loan landscape for individuals with bad credit. The city has experienced fluctuations in employment rates, with certain sectors facing challenges due to automation and shifting market demands. As a result, many residents find themselves in precarious financial situations, making access to best unsecured personal loans for bad credit loans a critical issue.

However, the rise of the gig economy and alternative work arrangements has created new opportunities for individuals to supplement their income. This shift may present a pathway for borrowers to improve their financial situations and, ultimately, their credit scores. By leveraging flexible work options, individuals can increase their earnings, pay down debt, and potentially qualify for better loan terms in the future.

Conclusion: A Path Forward

As the demand for personal loans for bad credit continues to grow in Knoxville, it is essential for borrowers to remain informed and vigilant. The experiences shared by individuals in this study highlight the importance of understanding the implications of borrowing and the potential risks associated with high-interest loans. Additionally, the role of alternative lenders necessitates a closer examination of lending practices and the need for consumer protections.

Moving forward, a collaborative effort among financial institutions, community organizations, and policymakers is crucial in addressing the challenges faced by borrowers with bad credit. By promoting financial education, advocating for responsible lending practices, and creating pathways for economic empowerment, Knoxville can work towards a more equitable financial landscape for all its residents. Ultimately, the goal should be to foster a community where individuals can access the financial resources they need to thrive, regardless of their credit history.