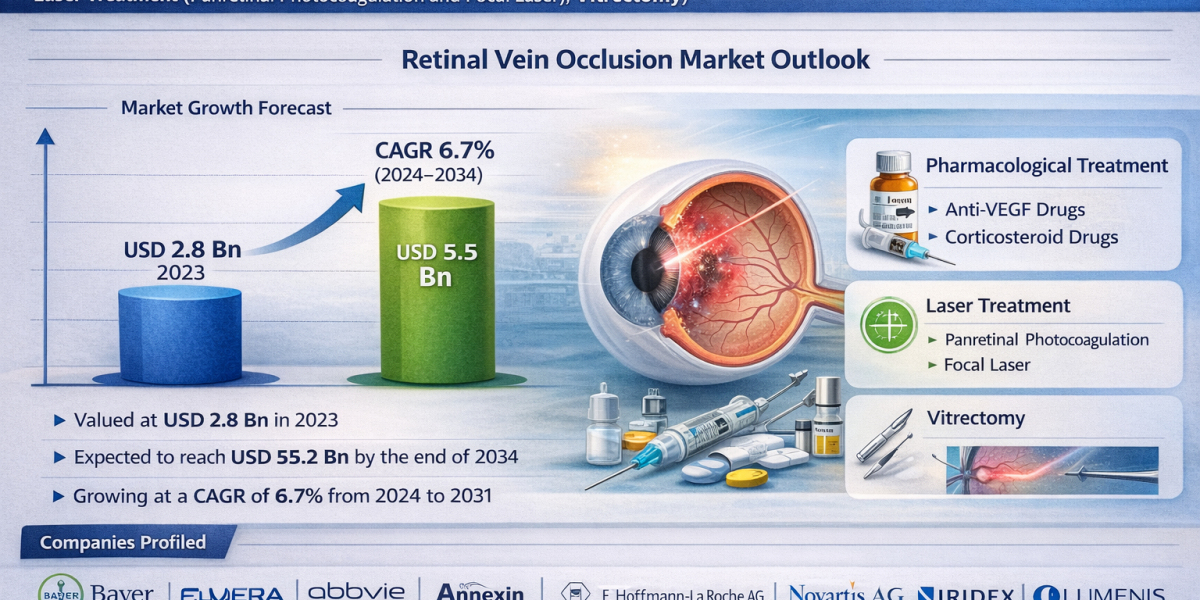

The global retinal vein occlusion market was valued at USD 2.8 billion in 2023 and is expected to cross USD 5.5 billion by the end of 2034. The industry is projected to grow at a strong CAGR of 6.7% from 2024 to 2034, driven by the rising prevalence of retinal disorders, an aging global population, increasing adoption of advanced anti-VEGF therapies, and improved diagnostic and treatment accessibility worldwide.

The Retinal Vein Occlusion (RVO) market is poised for substantial growth, driven by the increasing prevalence of retinal vein occlusion. Rising awareness about the importance of early diagnosis and advanced treatment options is expected to boost market expansion. The development and approval of novel therapeutic agents, such as anti-VEGF drugs and corticosteroids, are enhancing treatment efficacy and improving patient outcomes, further propelling market growth.

Transform Your Strategy: Explore In-Depth Data – Sample Available! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=60489

Increasing regulatory approval for retinal vein occlusion (RVO) treatment products is expected to act as a significant driver for the RVO market over the forecast period. Regulatory approvals from authoritative bodies such as the FDA and EMA can expedite the market entry of new and innovative treatments, allowing pharmaceutical companies to bring their products to patients more quickly and efficiently

Market Segmentation

Segment Category | Sub-Segments |

By Service Type | Diagnostic Imaging (OCT, Angiography), Therapeutic Injections, Laser Surgery |

By Sourcing Type | In-house R&D (Branded Biologics), Contract Manufacturing, Biosimilars/Generics |

By Application | Macular Edema, Retinal Ischemia, Neovascularization Management |

By Industry Vertical | Hospitals & ASCs, Specialized Ophthalmic Clinics, Retail Pharmacies |

By Region | North America, Europe, Asia-Pacific, Latin America, MEA |

Regional Analysis

- North America: Currently dominates the market with over 41% share. This is fueled by high healthcare spending, a robust reimbursement landscape for anti-VEGF therapies, and early adoption of "next-gen" drugs like Vabysmo.

- Asia-Pacific: Projected to be the fastest-growing region with a CAGR of ~8.9%. Rapidly aging populations in Japan and China, combined with improving healthcare infrastructure, are driving massive volume growth.

- Europe: Maintains a steady share, focused heavily on cost-effectiveness and the integration of biosimilars into public health systems.

Market Drivers and Challenges

Drivers

- The "Silver Tsunami": As the global population over 65 is expected to double by 2050, the primary risk group for RVO is expanding.

- Diabetes & Hypertension Epidemic: Rising systemic vascular issues directly correlate with increased RVO incidence.

- Approval of Multi-Pathway Drugs: New therapies targeting both VEGF and Ang-2 (like faricimab) offer better durability, reducing the "needle-in-eye" frequency.

Challenges

- High Treatment Cost: Premium biologics can cost over $1,000 per dose, making long-term treatment a financial strain without insurance.

- Patient Non-Compliance: The "fear factor" of frequent intravitreal injections leads to many patients dropping out of treatment, causing vision regression.

- Diagnostic Gaps: In developing regions, RVO is often misdiagnosed as simple "age-related vision loss" until significant damage is done.

Market Trends

- The Biosimilar Wave: With patents for blockbusters like Eylea and Lucentis expiring/expired, biosimilars (e.g., Byooviz) are entering the market, drastically lowering costs.

- Long-Acting Delivery: Research into port delivery systems and sustained-release implants aims to extend the time between treatments from 4 weeks to 6 months.

- AI Diagnostics: AI algorithms integrated into OCT machines are now helping clinicians predict which patients will respond best to specific steroids vs. anti-VEGF drugs.

Future Outlook

The next decade will see a pivot toward personalized medicine. We expect the market to move away from "one-size-fits-all" monthly injections toward gene therapy (one-time treatments) and combination therapies that address inflammation alongside vascular leakage. By 2034, the retail pharmacy segment is expected to grow as more "take-home" or less-invasive monitoring tools become available.

Key Market Study Points

- CRVO vs. BRVO: CRVO currently accounts for roughly 71% of market revenue due to the intensity of treatment required.

- Anti-VEGF Dominance: This segment holds nearly 67% of the treatment share as the gold standard of care.

- Hospital Dominance: Hospitals remain the primary hub for treatment due to the specialized nature of intravitreal injections.

Competitive Landscape

The market is highly concentrated among a few biopharma giants, though "emerging disruptors" are gaining ground in the biosimilar and gene therapy space.

- Bayer AG

- Alimera Sciences

- AbbVie

- Annexin Pharmaceuticals AB

- F. Hoffmann-La Roche AG

- Novartis AG

- IRIDEX Corporation

- Lumenis

- Nidek Co., Ltd.

- Regeneron Pharmaceuticals, Inc.

Recent Developments (2024-2026)

- In May 2023, Bayer conducted a phase III QUASAR study to evaluate the efficacy and safety of aflibercept 8 mg in treating macular edema due to retinal vein occlusion. The study enrolled around 800 patients in 27 countries and measure changes in the best corrected visual acuity. The study follows regulatory authorization applications for aflibercept 8 mg in the EU and Japan.

- In October 2023, Genentech received approval by the FDA for treating retinal vein occlusion (RVO), age-related macular degeneration (AMD), and diabetic macular edema. The drug, Vabysmo, is the first and only bispecific antibody approved for the eye, showing early and sustained vision improvements as compared to aflibercept.

- In August 2023, Regeneron Pharmaceuticals, Inc. reported that the U.S. Food and Drug Administration (FDA) granted approval for EYLEA HD (aflibercept) Injection 8 mg as a treatment option for individuals with wet age-related macular degeneration (wAMD), diabetic macular edema (DME), and diabetic retinopathy (DR).

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com