In recent years, investors have increasingly sought alternative assets to diversify their retirement portfolios. One such option that has gained popularity is the American Gold Bullion Individual Retirement Account (IRA). This article aims to provide a comprehensive overview of what a Gold Bullion IRA is, its benefits, potential drawbacks, and how to set one up.

What is a Gold Bullion IRA?

A Gold Bullion IRA is a type of self-directed Individual Retirement Account that allows investors to hold physical gold and other precious metals as part of their retirement savings. If you cherished this article and you simply would like to obtain more info relating to gold ira companies us please visit our web page. Unlike traditional IRAs, which typically include stocks, bonds, and mutual funds, a Gold Bullion IRA permits the inclusion of IRS-approved gold coins, bars, and bullion. This alternative investment vehicle appeals to those who want to hedge against market volatility and inflation.

The Benefits of a Gold Bullion IRA

- Inflation Hedge: Gold has been historically recognized as a safe haven during economic downturns and periods of high inflation. By including gold in your retirement portfolio, you can potentially safeguard your assets against the eroding effects of inflation.

- Portfolio Diversification: A Gold Bullion IRA allows investors to diversify their portfolios beyond traditional assets. Diversification can reduce overall risk and improve potential returns by spreading investments across different asset classes.

- Tangible Asset: Unlike stocks or bonds, gold is a physical asset that you can hold in your hand. This tangibility can provide a sense of security for investors who are wary of digital or paper assets.

- Tax Advantages: Similar to other IRAs, Gold Bullion IRAs offer tax benefits. Contributions may be tax-deductible, and the investment grows tax-deferred until withdrawal. This can lead to significant tax savings over time.

- Protection Against Currency Fluctuations: Gold is a global currency that retains its value regardless of the fluctuations in the U.S. dollar or other fiat currencies. This characteristic makes it a valuable asset during times of economic uncertainty.

Potential Drawbacks of a Gold Bullion IRA

- Storage and Insurance Costs: Physical gold must be stored in a secure, IRS-approved facility, which can lead to additional costs. Investors may also need to purchase insurance to protect their assets, further increasing expenses.

- Limited Liquidity: While gold can be sold relatively easily, converting physical gold into cash can take time and may involve transaction fees. This limited liquidity can be a disadvantage for investors who may need quick access to funds.

- Market Volatility: Although gold is often seen as a safe haven, its price can be volatile in the short term. Investors should be prepared for fluctuations in the market value of their gold holdings.

- Complexity of Regulations: Gold Bullion IRAs are subject to specific IRS regulations regarding the types of gold that can be included. Navigating these rules can be complex, and mistakes can lead to penalties or disqualification of the IRA.

- Potential for Lower Returns: gold ira companies us Historically, gold has not outperformed stocks over the long term. While it can provide stability, investors should be aware that relying too heavily on gold may limit overall portfolio growth.

How to Set Up a Gold Bullion IRA

Setting up a Gold Bullion IRA involves several steps:

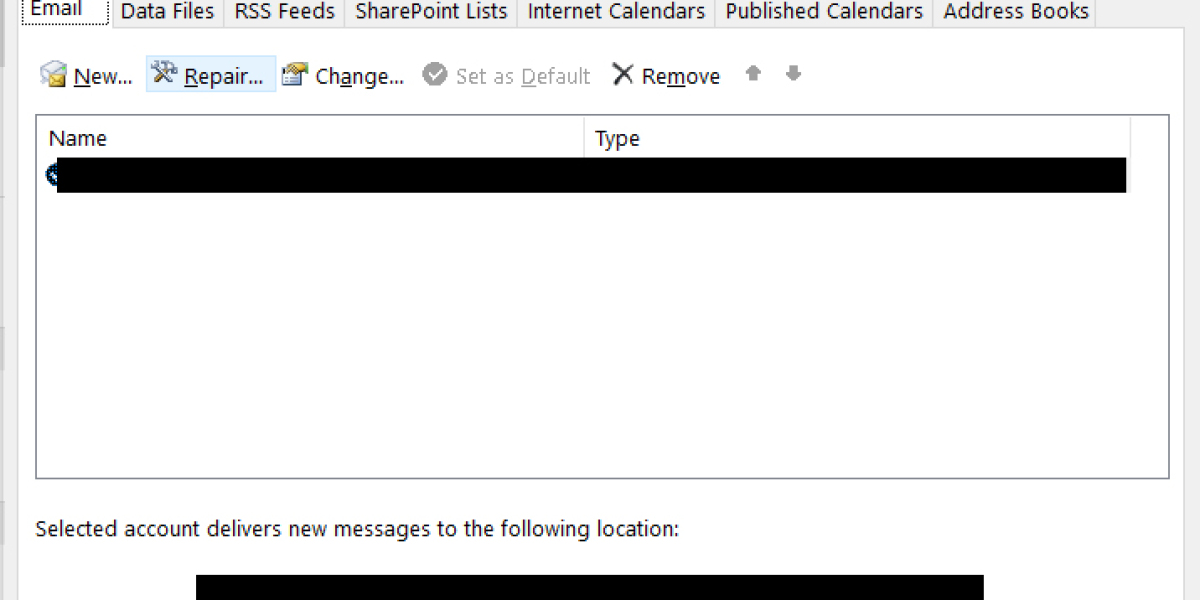

- Choose a Custodian: The first step is to select an IRS-approved custodian who specializes in Gold Bullion IRAs. The custodian will handle the administrative aspects of your account, including storage and compliance with IRS regulations.

- Fund Your Account: You can fund your Gold Bullion IRA through a rollover from an existing retirement account, a direct contribution, or a transfer from another IRA. Be sure to consult with a financial advisor to understand the tax implications of each option.

- Select Your Precious Metals: Once your account is funded, you can choose the types of gold and other precious metals you wish to include. The IRS has specific requirements for the types of gold that can be held in an IRA, including purity standards. Approved gold coins include the American Gold Eagle, Canadian Gold Maple Leaf, and others.

- Place Your Order: After selecting your metals, your custodian will facilitate the purchase and ensure that the metals are stored in an approved depository. It is essential to keep records of all transactions for tax purposes.

- Monitor Your Investment: As with any investment, it is crucial to regularly review and monitor your Gold Bullion IRA. Stay informed about market trends, gold prices, and any changes in IRS regulations that may affect your account.

Conclusion

A Gold Bullion IRA can be an excellent addition to a diversified retirement portfolio, offering unique benefits such as protection against inflation and market volatility. However, it is essential to carefully consider the potential drawbacks, including storage costs and market fluctuations. By understanding the intricacies of Gold Bullion IRAs and following the proper steps to set one up, investors can make informed decisions that align with their long-term financial goals. As always, consulting with a financial advisor is recommended to ensure that a Gold Bullion IRA is the right choice for your individual circumstances.

In conclusion, while a Gold Bullion IRA offers a unique way to invest in precious metals for retirement, it is crucial to approach this investment with a clear understanding of its benefits and challenges. By doing so, investors can navigate the complexities of this alternative asset class and work towards a secure financial future.